New Extended Hours. See Footer.

ROMA SHERWOOD PARK DELIVERS TO YOU DIRECTLY

“We ensure the best prices and service when you order from us directly. Get 10% OFF All online pickup orders”

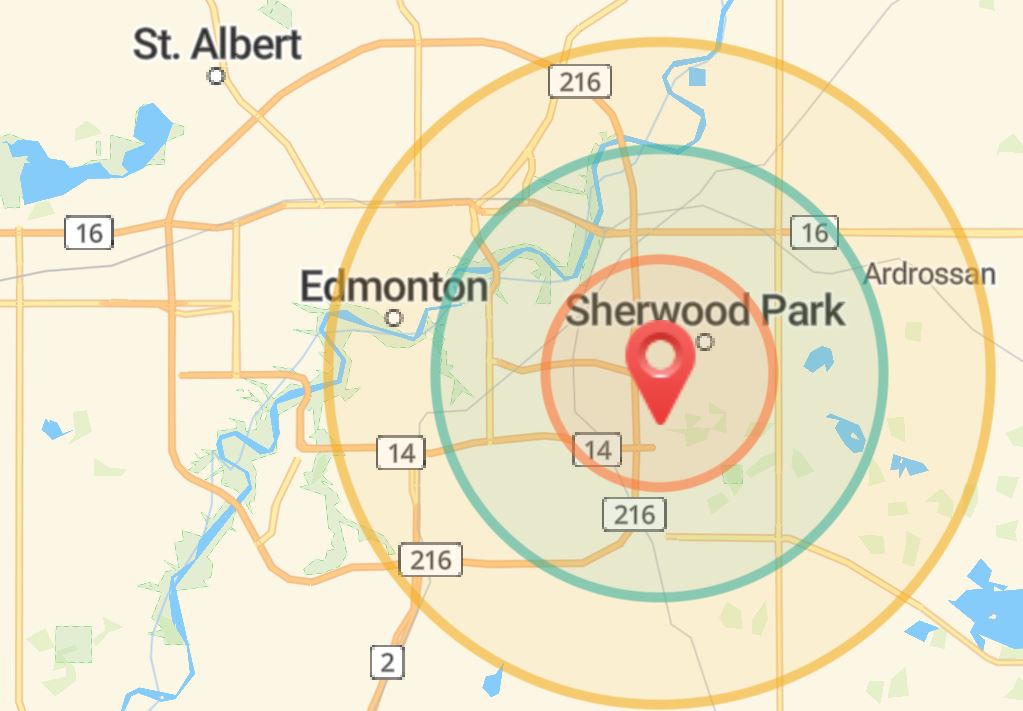

- $25 Min Order - $5 Fee (Inner Red Zone)

- $25 Min Order - $6 Fee (Middle Green Zone)

- Delivery to Ardrossan upon request

Made from the fresh Dough. Our unique recipe is the key that gives us a competitive edge. We focus customer preferences and trim our products as per their taste

Fresh

Quality

Offers